Why Does China Want Lithium? Understanding Its Strategic Importance

China’s demand for lithium has surged, with imports reaching 106,389 tonnes in the first half of 2025, a 45.39% increase from the previous year. This high import volume reflects China’s strategic push to secure enough lithium to meet its growing needs, especially in electric vehicle (EV) production and renewable energy storage solutions.

How Does Lithium Carbonate Fit Into China’s Energy Strategy?

Lithium carbonate is a crucial component for manufacturing lithium-ion batteries, which are essential for EVs and energy storage systems. As part of its energy strategy, China aims to reduce reliance on fossil fuels and increase the share of renewable energy sources. This transition heavily relies on efficient battery technologies, making lithium carbonate indispensable.

| Component | Importance |

|---|---|

| Lithium Carbonate | Key ingredient for battery production |

| Renewable Energy | Supports transition to green energy |

| Electric Vehicles | Drives demand for efficient battery solutions |

Why Is Lithium Considered Essential for China’s Electric Vehicle Market?

Lithium is vital for the production of batteries used in electric vehicles. As one of the largest markets for EVs globally, China has invested heavily in developing a robust domestic battery manufacturing industry. With EV sales projected to grow significantly, securing a stable supply of lithium is crucial to maintaining production levels and meeting consumer demand.

What Are the Implications of High Lithium Imports for Global Pricing?

High imports of lithium by China can exert downward pressure on global prices due to increased supply availability. However, as demand fluctuates and new production capacities come online, prices can also experience volatility. Analysts predict that while current oversupply may lead to lower prices, future demand increases could stabilize or even raise prices again.

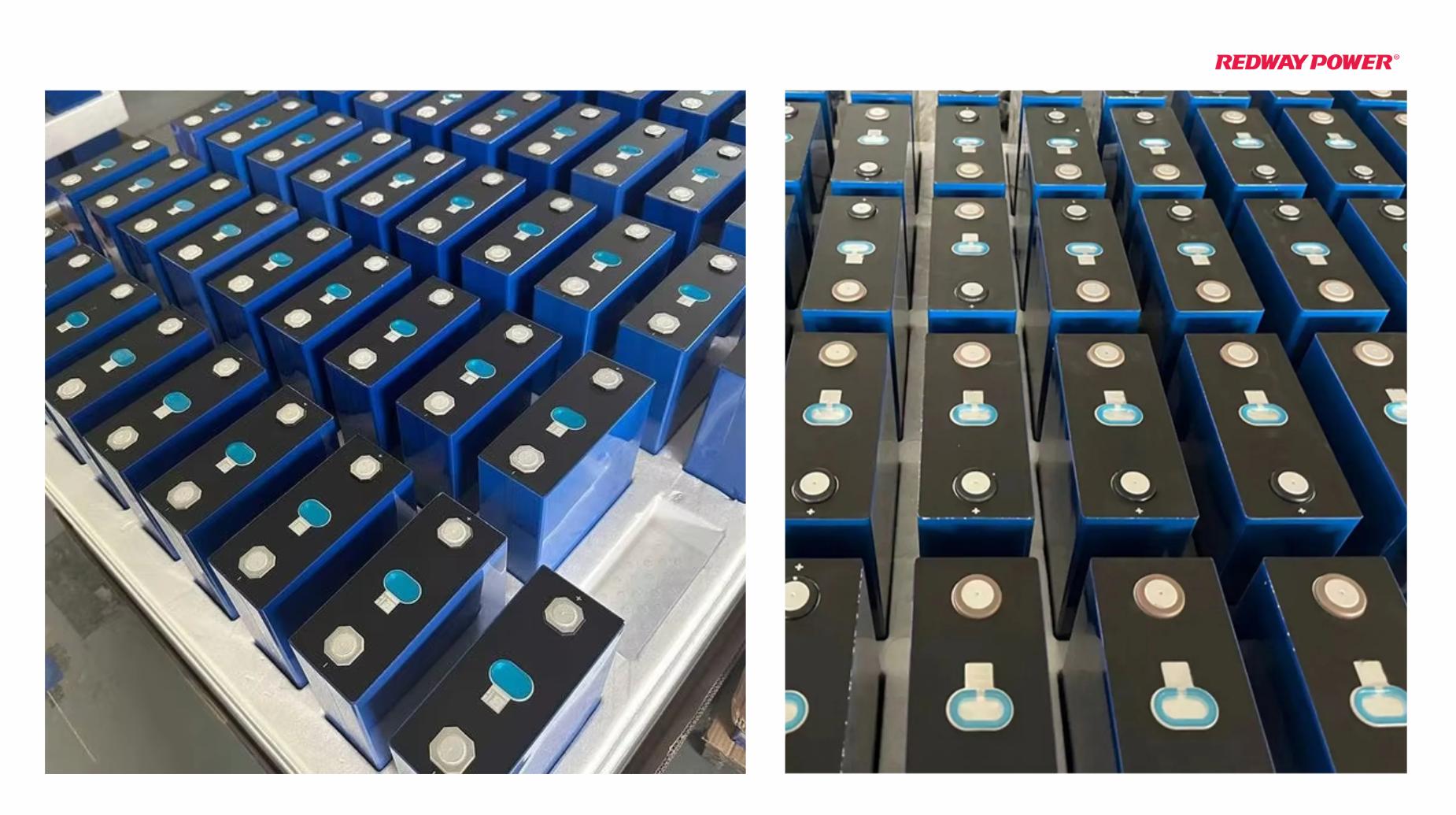

Why Is Lithium Critical for China’s Battery Manufacturing?

Lithium’s critical role in battery manufacturing stems from its ability to enhance energy density and efficiency in lithium-ion batteries. As China seeks to dominate the global battery market, securing a reliable supply of high-quality lithium becomes paramount. This focus on lithium ensures that Chinese manufacturers can produce competitive and advanced battery technologies.

How Does China’s Demand for Lithium Impact Global Markets?

China’s insatiable demand for lithium significantly influences global markets. As the largest consumer of lithium, fluctuations in Chinese demand can lead to price changes worldwide. Countries rich in lithium resources, such as Australia and Chile, are closely monitoring these dynamics as they seek to capitalize on their resources while navigating trade relationships with China.

| Market Influence | Description |

|---|---|

| Price Volatility | Changes in Chinese demand affect global prices |

| Resource Allocation | Countries adjust exports based on Chinese needs |

| Trade Relationships | Geopolitical factors influence supply chains |

What Role Do Tariffs Play in China’s Lithium Strategy?

Tariffs imposed by countries like the U.S. and those within the EU aim to protect local industries but also impact China’s strategy. Increased tariffs on Chinese EVs and batteries could lead Chinese manufacturers to seek alternative markets or relocate production facilities abroad. This shift may help mitigate costs while maintaining access to essential resources.

How Is China Securing Its Lithium Supply Through International Investments?

China is actively securing its lithium supply through strategic investments in lithium-rich countries. By acquiring stakes in mines across Australia, Chile, and Argentina, Chinese companies ensure a steady flow of raw materials necessary for their battery production. This approach not only secures resources but also strengthens geopolitical ties with these nations.

Industrial News

Recent developments indicate that China’s demand for lithium continues to grow amid rising electric vehicle sales and renewable energy initiatives. In 2025, imports have surged significantly despite global price fluctuations due to oversupply concerns. As geopolitical tensions rise, China is increasing its investments overseas to secure access to vital resources while navigating trade challenges posed by tariffs from other countries.

LiFePO4 Battery Expert Views

“China’s aggressive pursuit of lithium resources reflects its strategic vision for leading the green technology revolution,” states Dr. Emily Wang, an expert in energy storage technologies. “As competition intensifies globally, securing reliable access to these critical materials will be essential not just for economic growth but also for national security.” This perspective highlights how vital lithium is becoming on both economic and geopolitical fronts.