How Does China’s Lithium Production Compare Globally?

China is a major player in the global lithium market, ranking as one of the top producers. In 2025, China’s estimated lithium production reached 33,000 metric tons, making it the third-largest producer globally. Despite this, recent reports indicate that production may be affected by various factors, including operational halts at key mines and shifts in market demand.

How Does CATL’s Production Cut Impact the Global Lithium Market?

Contemporary Amperex Technology Co., Limited (CATL), one of the world’s largest lithium-ion battery manufacturers, has announced plans to cut lithium carbonate production. This decision is expected to reduce China’s monthly lithium output by 8%. The cutback aims to stabilize oversupply issues and potentially drive up global prices, which have seen significant declines recently due to decreased demand from electric vehicle (EV) manufacturers.

| Impact Factor | Description |

|---|---|

| Production Reduction | CATL’s cut will reduce output by 8% |

| Price Stabilization | Expected increase in global lithium prices |

| Market Response | Other producers may follow suit |

What Are the Future Projections for Lithium Prices?

Due to recent production cuts and an anticipated increase in demand, analysts predict that lithium prices may rebound significantly. UBS forecasts an 11–23% increase in prices through 2025 as supply adjustments take effect. Current estimates suggest that prices could stabilize between $10,000 and $11,000 per ton, reflecting a recovery from recent lows.

How Does China’s Lithium Production Affect Electric Vehicle (EV) Manufacturers?

China’s dominance in lithium production directly influences EV manufacturers worldwide. As a key ingredient in EV batteries, fluctuations in lithium availability and pricing can impact production costs and vehicle pricing. The recent production cuts by CATL may lead to increased costs for battery manufacturers, potentially affecting EV pricing and availability.

| Factor | Description |

|---|---|

| Supply Dependency | EVs rely heavily on stable lithium supply |

| Cost Implications | Price increases may lead to higher EV costs |

| Market Dynamics | Changes in supply can affect overall EV sales |

What Are the Implications of Halting Lithium Mining in Jiangxi?

The decision to halt operations at a major lithium mine in Jiangxi province is poised to have significant implications for China’s overall lithium output. This mine was expected to contribute substantially to national production levels. The cessation of operations could exacerbate existing supply shortages and further influence global market dynamics.

How Will This Affect China’s Lithium Output?

Halting mining activities will likely reduce China’s overall output capacity, contributing to tighter supply conditions. Analysts estimate this could lead to a 20–25% rise in global lithium prices over the next few months as markets adjust to reduced availability from one of the largest producers.

What Trends Are Influencing Global Lithium Prices?

Several trends are currently shaping global lithium prices:

- Supply and Demand Imbalance: An oversupply situation has led to falling prices, but recent production cuts may help rebalance this.

- Geopolitical Factors: International tensions and trade policies are affecting how countries source their lithium.

- Market Sentiment: Investor confidence fluctuates based on news regarding production capabilities and technological advancements in battery storage.

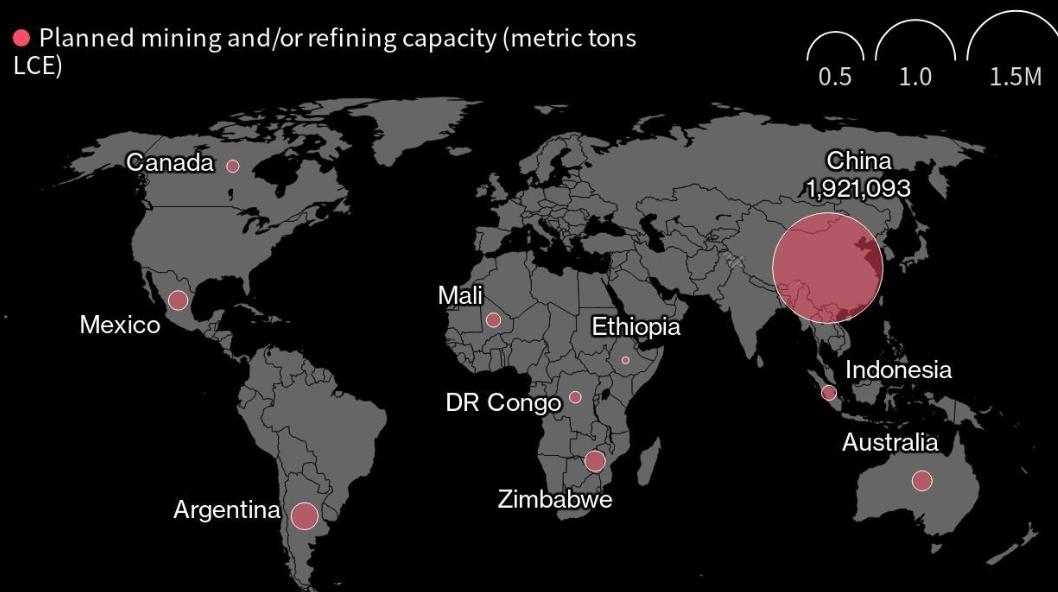

What Role Does China Play in the Global Lithium Supply Chain?

China plays a crucial role in both mining and processing lithium globally. While it holds only about 8% of the world’s known lithium reserves, it dominates refining capabilities, processing approximately 67% of global supply. This dual role allows China to maintain significant influence over pricing and availability on international markets.

| Role | Description |

|---|---|

| Mining Capacity | Third-largest producer globally |

| Processing Dominance | Processes 67% of global lithium supply |

| Strategic Influence | Controls pricing through supply management |

Industrial News

Recent developments indicate that China is adjusting its approach to lithium production amidst fluctuating market conditions. The halting of operations at key mines like those in Jiangxi reflects broader trends aimed at stabilizing oversupply issues that have led to significant price declines. As demand for electric vehicles continues to grow, these changes could reshape market dynamics both locally and globally.

LiFePO4 Battery Expert Views

“China’s strategic control over both mining and refining processes gives it a substantial advantage in the global battery market,” states Dr. Emily Wang, a leading expert on energy storage solutions. “As countries seek to diversify their supply chains away from China, we may see increased competition and innovation emerge within this critical sector.” This perspective highlights ongoing shifts that could redefine how countries approach their energy needs moving forward.